Sustainable cleaning: Our commitment to a greener future

By Brad Reames (pictured), Owner and Managing Director of Peartree Cleaning Services In an era defined by environmental challenges, businesses

By Brad Reames (pictured), Owner and Managing Director of Peartree Cleaning Services In an era defined by environmental challenges, businesses

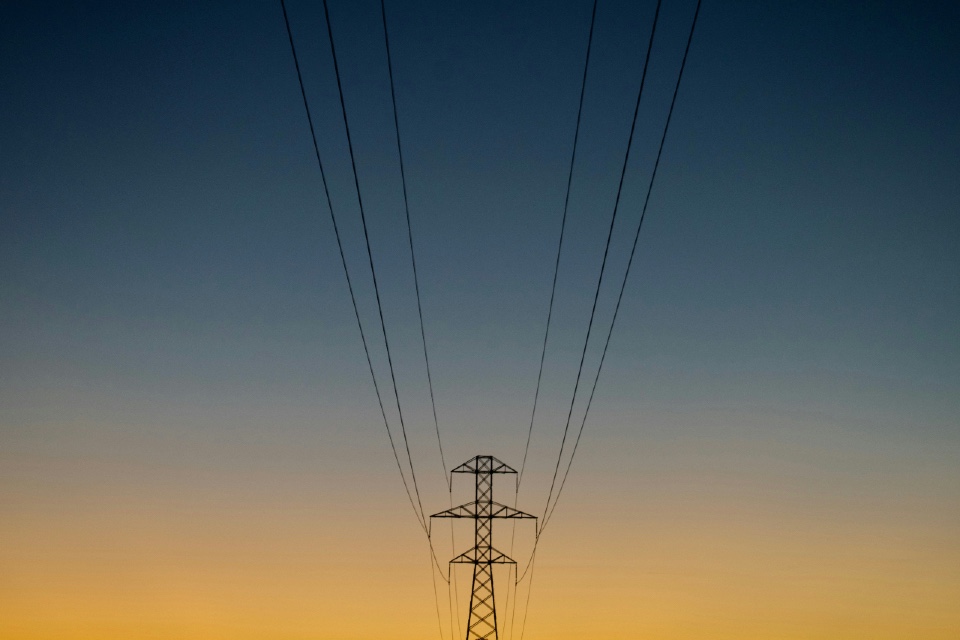

Energy as a Service (EaaS) is emerging as a preferred model for Facilities Managers seeking to improve sustainability, reduce energy

You and your colleagues have an exclusive invite to the Facilities Management Forum taking place on Monday 23rd and Tuesday 24th June – just

Each month on FM Briefing we’re shining the spotlight on a different part of the facilities management market – and

The right energy management platform does more than track kilowatt-hours: it provides a centralised, intelligent system that supports sustainability goals,

With spring in full swing, invasive plant species such as Japanese Knotweed and Himalayan balsam are beginning to grow –

Despite various environmental initiatives within the painting industry to help recycle plastic and metal paint packaging, a high percentage of

Veolia’s Newhaven and Marchwood Energy Recovery Facility (ERF) teams marked National Careers Week 2025 with a series of Insight Days,

Leading FM teams across the UK’s public and private sectors are embracing integrated energy strategies — where energy monitoring, planned maintenance,

There’s a complimentary guest pass reserved for you to attend the upcoming Facilities Management Forum in June – here’s everything you need to

JLL’s latest Corporate Capital Markets report indicates that corporate real estate disposals in EMEA reached €15.7 billion in 2024, showing

The integration of smart technologies such as the Internet of Things (IoT), Computer-Aided Facilities Management (CAFM) systems, and Artificial Intelligence (AI) is reshaping how Total FM contracts

Chelsea Football Club entered a global partnership with Vietnam’s FPT Corporation (FPT), which specialises in supporting the digital transformation, encompassing

Each month on FM Briefing we’re shining the spotlight on a different part of the facilities management market – and

Aston University has been awarded a £35.5 million grant from the UK Public Sector Decarbonisation Scheme to support its transformation